- The Menu

- Posts

- Sunday Ghospel

Sunday Ghospel

Reflections and Outlooks. On Sundays.

Happy Sunday

I am back from Oktoberfest. There is a German wisdom that states:

Everything has an ending.

Only the sausage has two.

I never really knew what to do with that info. Until now. I have now been not once but two times to the now in my mind iconic Oktoberfest tent: Bratwurst.

Fed with a years worth of pretzels and beer I am keen to pick up my regular writing again and share this weeks main events and outlooks.

Cheers

Philip

The week in review

Taking the temperature

254k new jobs in September—far better than the 140k economists expected. Best number in six months. July and August revised up too, by 72k combined. Unemployment dipped to 4.1% from 4.2%.

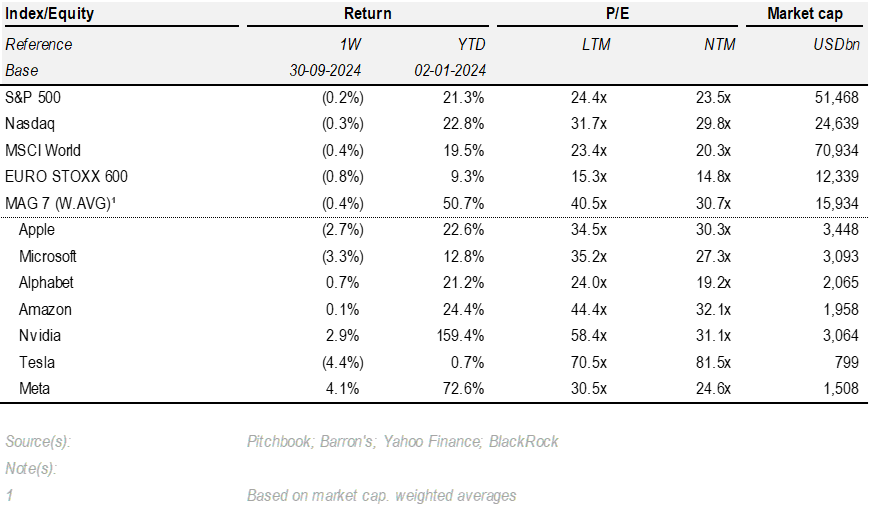

Stock market? Same pattern as August. Big dip first week, then a rally. S&P 500 closed September at a record high—total return of 2.1%. That’s 10 positive months out of 11

Venture tabs

This week in global VC funding

EUR 13bn invested. Ex Open AI this is c. EUR 4bn.

525 completed deals

Top Funding Rounds

Open AI | US | EUR 9.5bn @ EUR 135bn pre-money | GenAI - does it really need an explanation?

Poolside | France | EUR 450m @ EUR 2.25bn pre money | AI based software development platform

Kailera Therapeutics | US | 360m | Obesity-centric BioPharma

Zepz | EUR 240m | UK | EUR 240m | Online payment and money transfer platform

Aktis Oncology | US | EUR 158m | Radiopharma

Newcleo | France | EUR 134m | Nuclear energy tech

Impulse Space | US | EUR 135m @ EUR 324m pre-money | Aviation and aero components for last mile space payload delivery

Koho | Canada | EUR 126m | Money management tool

Nusano | US | EUR 104m | MedTech manufacturing

Triveni Bio | US | EUR 104m | Drug discovery platform

Top Investors

Including only accelerators when and where relevant

Andreessen Horowitz | US | 5 Investments

BoxGroup | US | 5 Investments

Plug and Play | US | 5 Investments

Y Combinator | US | 5 Investments

HeartX | US | 4 Investments

Cherry Ventures | Germany | 3 Investments

Founders Factory | UK | 3 Investments

Taisu Ventures | Singapore | 3 Investments

Techstars | US | 3 Investments

Vento | Italy | 3 Investments

What a week. Open AI jus raised the biggest funding round in VC ever. Led by Thrive Capital. Microsoft, Nvidia and Softbank participated as well. At a valuation that seems bullish to many - EUR 141bn post money. The EUR 9.5bn of which just shy of EUR 4bn was in credit (all the big boys: Goldman, JP etc. got in on the action @ a 100bp over SOFR spread) marks not just the biggest funding round in VC history but also comes in just as the company has announced further management changes. excluding Sam Altman all founders have left. Now top further top and mid level management is leaving the company. Often cited are personal reasons and wanting to focus on personal projects / ventures. This is common for companies that fail to attract capital or generate liquidity. Open AI however is just the opposite of that.

I dug around to give this story a bit of colour. some news outlets are quoting a confirmed top line (not all recurring but I imagine most to be) @ USD 3.7bn this year (mind you they are still expected to look at USD 5bn in net losses this year). Seems in line with the reported figure of August for 300m in MRR - linearly this gives us just about the annual figure. Moving on to next year’s projected figures. Revenue expectations are quoted @ USD 11.6bn for 2025. In a simplified world this is an NRR of c. 313%. Markedly above SaaS averages. At next years revenue this is an implied EV / Sales of c. 13.5x. Its steep but not unheard of and looking at BSV’s Cloud 100 Index we can see: Top 100 cloud companies are demanding somewhere around 8x ARR. But they also grow a lot slower than Open AI currently is. I think the valuation seems crazy at first (its now ahead of players like Lockheed and just in reach of Goldman Sachs). But on closer inspection it could make sense - all comes down to how much credibility one places in the revenue growth expectations.

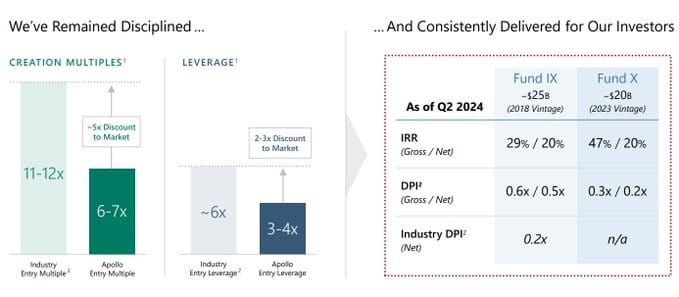

Not exactly VC but private markets related and news so big that I almost considered fleeing the Oktoberfest tents just to write about this. Apollo - in tandem with their new USD 25bn Private Credit partnership with Citi - had their investor day. A day it was.

Takeaways just in line with what the KKR report I wrote about recently revealed. great podcast episode with CEO marc rowan on Bloomberg summarising the key messages as well - link here. Some snippets and my key takeaways below:

Private capital (particularly private credit - naturally Apollo focusing on this asset class for now) should not be considered alternative capital but a standard asset class

The asset is class is booming and benefitting from substantial tailwinds

When it first originated private capital was rigid and seen mostly as high risk capital in high yield transactions

Today the picture has shifted significantly

Private capital is highly flexible offering solutions where public capital cannot provide

Funding needs for infrastructure and digitalisation have become so large that private capital will need to play an increased role

Private credit used to be associate with high yield transactions for companies with riskier profiles. Top tier transactions on triple A names are seen more frequently

Growth of alternative capital

Need for capital & private capital providers

Alternative no more. New asset classes are becoming key to an enhanced / optimised investment portfolio.

Apollo returns looking strong - low entry multiples and lower leverage minimising risk on exit valuations to deliver strong returns.

The most important slide. Memes have reached the mahogany halls of Apollo. How could one not love them.

The week ahead

Economic Events

We have important reads upcoming in the US but all in all not too busy in terms of volume of released data.

Tuesday

RBNZ Interest Rate Decision

The New Zealanders are expected to cut rates by 50bps down to 475bps

Wednesday

FOMC minutes after the US 10 Year Note Auction

Thursday

US CPI for September - the FEDs fan favorite inflation read

Core CPI MoM

Estimate: 0.2%

Last: 0.3%

CPI YoY

Estimate: 2.3%

Last: 2.5%

Fresh off the Fed's rate cut, CPI report drops Thursday. Key question—did inflation keep cooling in September? August CPI hit 2.5% (lowest since Feb 2021), down from July's 2.9%. Let’s see if the trend holds

I agree with the sentiment shared by Thorsten Slok and Marc Rowan: The economy does not seem all that week. Employment figures and growth are pointing in a strong direction. I do not see the need for another cut in November unless data comes in to support it. The market is turning more hawkish as well. Add to this Druckenmiller:

Friday

German CPI report for September

MoM

Estimate: 0.0%

Last: 0.0%

Earnings I will be watching

This week marks the kick off for financial services - starting Friday we will see how capital providers have fared this quarter (bold for convenience)

PepsiCo

Richardson Electronics

Delta

Dominos

BlackRock

Wells Fargo

JPM

BNY

Fastenal