- The Menu

- Posts

- Daiy Tidbits

Daiy Tidbits

Today’s market tids that caught my attention bits.

Evening all

some people are in the business of finding diamonds in the rough as they say. Some others - these Ohio farmers for example - as I learned today, turn dimes not into one but into 500,000 Dollars. As I continue to contemplate becoming a hobby diver for rare Cent coins in tourist wishing fountains, I, for now, stick with my hobby of sharing today’s musings

Cheers

Philip

Read

Atomico provides fresh wind to EU VC funding. The VC raised 1.2bn across two funds. 485m for Series A-stage companies (a bit reserved also for seed). Another 754m for a later stage / growth stage fund — Series B through pre-IPO is in target. The high raise for later stage hints at of course the larger tickets being written in that space but perhaps also an LP flight towards more tried and true businesses in seek for more proof / quality

Indian e-scooter developer Ather looks to raise 370m (reflecting just the primary. Incl. secondary 530m) in local IPO. The competitor of recently listed Ola Electric is eyeing a valuation of 1.5bn to 2bn

Permira increased takeover bid for Squarespace to 7.2bn (c. +300m vs. the prior bid). The PPS increase to 46.50 comes in as shareholders were advised to reject the most recent proposal for 44 per share.

PE sponsor Castik raised 2bn for third vintage beating the initial target set for 1.75bn

Schroders raised 400m for third European buyout fund

Visual

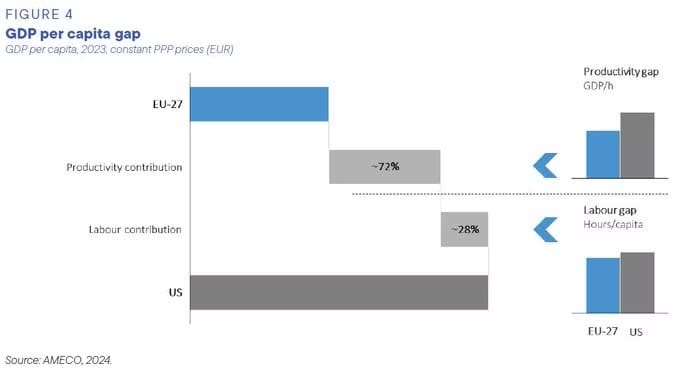

Draghi includes this power chart in his widely covered keynote speech today - the gist: GDP per capita in Europe is trailing the US significantly. Why? A glaring productivity gap (c .72% contribution to the gap). I added another FT chart to illustrate further.

ECB rate cut expectations by economists widely around the 250bps mark for this week’s meeting

BOFA shows the impact on EPS from tax hikes - the potential tax increase by 7pppts to 28% could see the wider S&P EPS trail down (4.7)% in 2025. Consumer and Commercial Services expected to be hit hardest

Just as commodities are trading at their lowest relative levels to total equities, copper could be set to be a bull amongst bulls. BOFA with the analysis again. Expectation sees a supply shortage of 15% by 2030. Yet some further input shows that inventories for copper are at all-time highs. Demand would have to supercharge (easily imaginable considering renewable infrastructure demand for the metal) while availabilities remain constrained. Some context: Biggest producers of copper globally are China, Congo, Chile and Peru. Largest Co’s that come to mind: Freeport-McMoRan, Codelco, BHP, Glencore and Southern Copper. If the coper play materialises or not, it still does not put a dent in the rally of the metal that is a fan favourite for culinary artists like Thomas Keller: L4Y copper prices have rallied 46%, which is already substantially below the copper peak price in May, when the gain was 110% L4Y.

Full-time employment has dropped by 1m in August on a YoY basis. Numero 7 in the consecutive monthly decline strikeboard. But who’s counting? I wonder: cut 25bps or 50bps (Traders on average price 240bps). And can this really still be called a soft landing (hinting at Yellen’s confident words on Saturday)? JPM’s head of econ does not seem to think so

[…] Weak even by the anemic standards of the 2010s expansion