- The Menu

- Posts

- Daily Tidbits

Daily Tidbits

Today’s market tids that caught my attention bits.

Evening all

Venezuela's President Maduro just had his plane seized in the US. In lack of a private plane, the most I've had seized at an airport is a slightly larger than 100ml bottle of water by the TSA. Blissfully unbothered by private-jet problems, I share today's tidbits.

Cheers

Philip

Read

In line with a global push to establish local technology expertise, particularly relying on semiconductor rollouts. In Germany, we have seen Black Semiconductor. In India, BigEndian Semiconductors has emerged. They raised 3m in seed equity. Led by Vertex Ventures and India. The company is tapping into local govvy efforts to establish India as a semi player. India set up a 9bn budget to bolster local semi and display manufacturing companies

Amazon acqui-hires founders and top talent (c. ¼ of the staff) from robotic AI software venture Covariant. This is aimed at providing tailwinds to Amazon’s warehouse automation business. The company previously raised 220m from Index, Amplify, Radical Ventures, CPPIB, Cascade, Northgate Capital, Gates Frontier and Temasek.

Ex Battery VC - Ramneek Gupta - raises 379m for PruVen Capital’s second vintage. Prudential is the anchor LP - the were the solo LP in the VC firm’s first 300m fund. Others include TIAA, Lincoln Financial, Generali, Nippon Life, Omaha Mutual, and Willis Towers Watson.

Visual

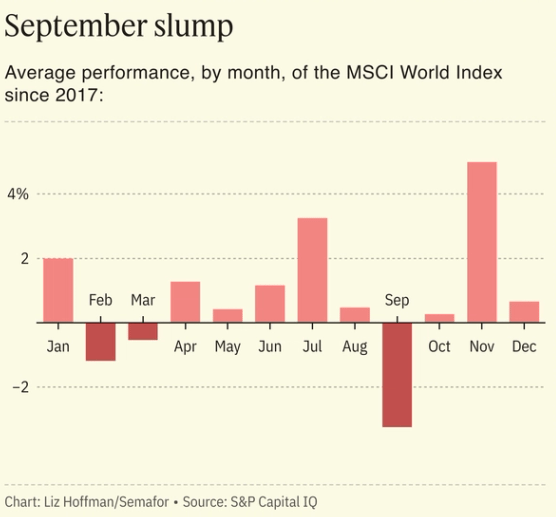

September has historically been the worst month for stock returns. Also the time Gold tends to shine. Not just literally. At record prices question is if the metal had not topped out. Alas - fresh out of Labour day weekend - September kicks off:

Falling tech stocks

Oil prices dropping

Gold dropping - prices usually this is the month the metal literally shines. Not this time. Almost like investors are in doubt of rate cuts

Bond prices trailing down almost like inflation expectations are rising

Conclusion: Risk off and side-lined market sentiment

ISM Manufacturing figures are in. Overall Index edged slightly better but below estimates. 47.2 vs. 47.5 est. and 46.8 prior. New orders trail down strongly - 44.6 vs. 47.4 prior. Outlook for manufacturing constrained. All eyes on the upcoming Service readings.

Europe is home to a vast number of the leading scientific research hubs globally. Yet European GDP and market share are declining. Would love to see this change. The (perhaps cheesy) line: Be the change you want to see, applies. Let’s back the ample number of great European founder teams to reposition us as a hub of innovation.

The US government gets a daily bill of 3bn to cover interest expenses. Provides me with a newfound appreciation for the relatively cheap-looking daily bills I pay. In anticipation of the September rate decision, Apollo estimates a 100bps cut (across the yield curve) would slash the daily US bill to 2.5bn

JetBrains is innovating its pricing model: The longer you stay. The less you pay. Target outcome is reduced churn and increased customer loyalty. As you achieve milestones you are further awarded with discounts. Interesting when considering that dynamic pricing has become a more prevalent topic. Even Coca Cola played around with the idea at a point.