- The Menu

- Posts

- Daily Musings

Daily Musings

Of Billion Dollar Unicorns and My Two Cents

Evening all

Sometimes hitting bull’s eye in darts is not the best strategy. I wouldn’t know anything about that as I only hit the single 1 and 7 tonight. As I am contacting the official darts championship to reconsider my proposal for a tournament of hitting the 1, I share my musings.

Cheers

Philip

Chart Art

A lot of my shares in Publix’s are starting with A and end with SML. Accordingly I am currently colour blindly to the colour red. ASML which I covered during my time as a a long only equity analyst has released unsatisfactory results. Ahead of schedule. Markets reacted accordingly. Bookings — an indicator of further demand — came in at about half the consensus. Looking across the semi supply chain this caused a drop in NVDIA prices and the Jenoprik ticker. ASML remains a monopoly name in its space and I continue to be bullish (this is not in any sense investment advise)Just to provide some context on the value chain: The only two companies that truly compete are Nikon and Canon and both have given up on trying to produce EUV equipment which ASML took c. 15 years of research for. The equipment back at its release came at a tag of c. 200m (2x the DUV equivalent). Its essential. Its a monopoly. Personally - without this being advise - I love the title and the product. Yu have question on the tech or the market? Ping me. Lets talk.

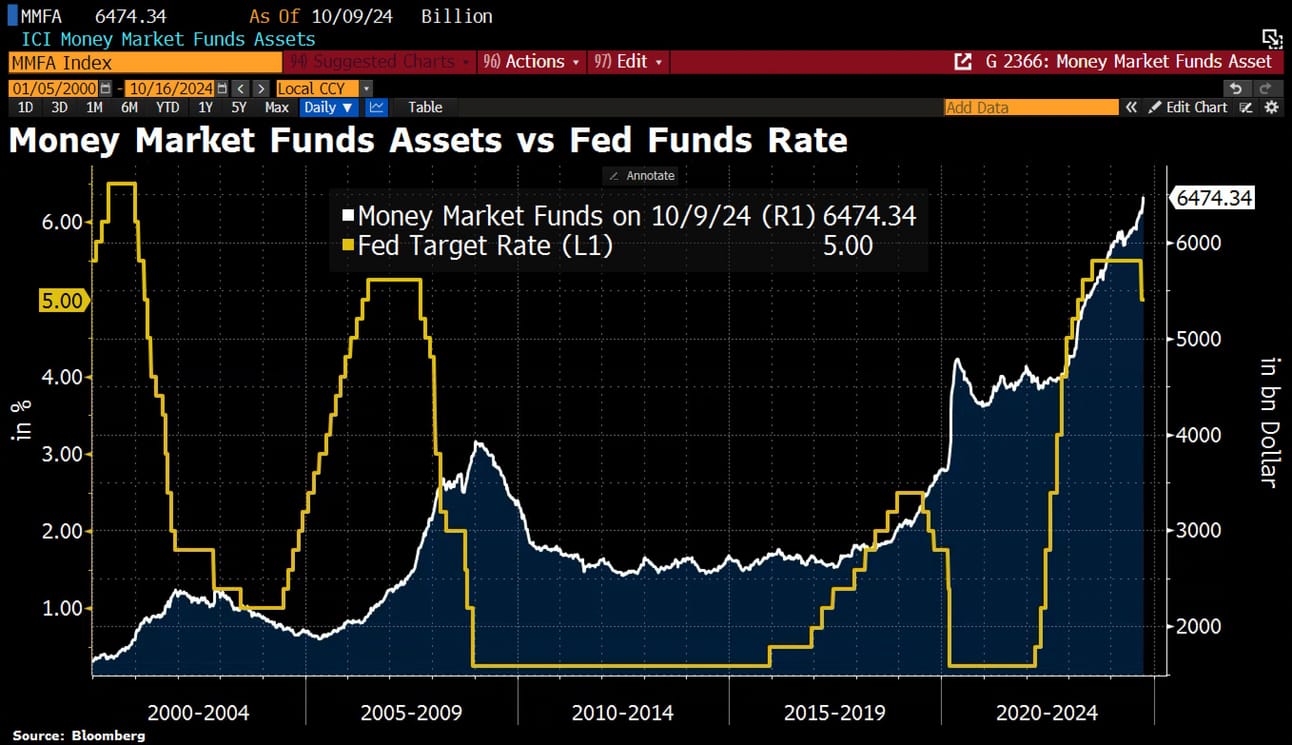

As mentioned yesterday: deposit savings in Q3 seem to be down. Money market fund inflow support the thesis. Hitting ATH @ USD 6.5tn

Post corona confidence was supposed to spark. In some markets it did but in China it sure didnt. below the Shanghai reads.