- The Menu

- Posts

- Daily Musings

Daily Musings

Of Billion Dollar Unicorns and My Two Cents.

Evening all

I'm kicking off the week in nostalgia. It's raining in Frankfurt, Autodoc is attempting an IPO, and markets are fretting about J Pow enjoying his money printer a bit too much. Sounds an awful lot like 2021 to me.

As I pinch myself and tell myself the old market adage: “This time its different”, I share my deja vu filled musings.

Cheers

Philip

Today’s Stories

Bloomberg reports Autodoc - the German auto parts seller - is planning a renewed IPO. Coming in after a failed attempt in 2021. Speculation sees the valuation at a steep discount to the EUR 10bn the company tried to bag in 2021. Some colour:

Reported revenue of EUR 1.3bn in 2024

Some 5k employees

Apollo got in @ a valuation of EUR 2.3bn last year for a minority stake

Space and DefenceTech gets its first Danish Fund: Final Frontier. The Fund led by Niels Vejrup Carlsen (spent the past 17 years @ SEED Capital) raised a EUR 150m vehicle to bolster the European defence sector

Chart Art

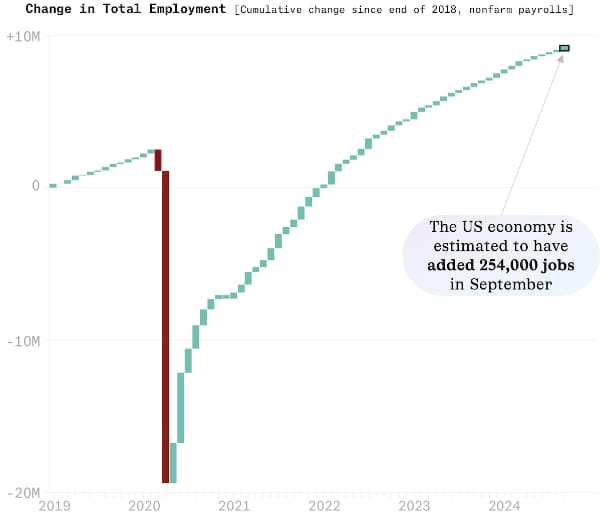

US nonfarm payroll blew the survey estimates out of the water. Of course subject to the grain of salt that is the shifting in survey trustworthiness as response rates have dropped. Nonetheless: Additional futter supporting a no change outlook for the Nov. FED Meeting. For some context. Goldman has cut US recession probabilities for next year to 15%

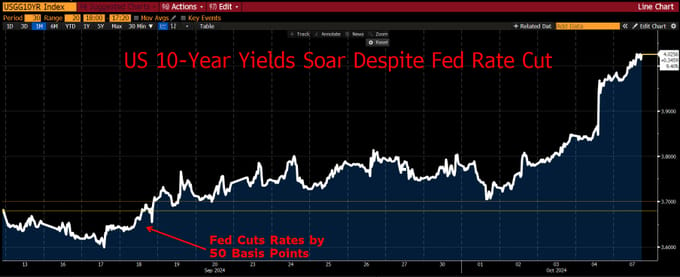

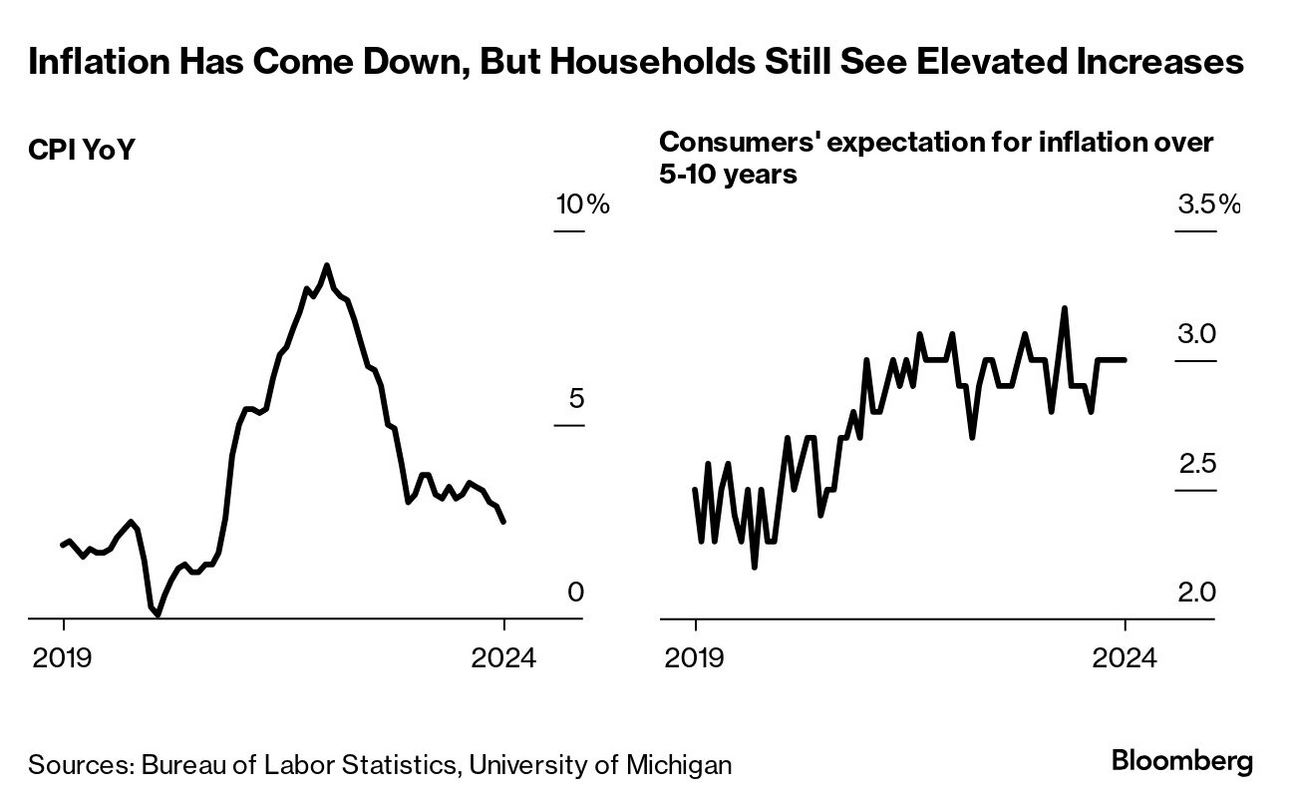

10Y Yields are through the roof. Now over 400bps. Usually one may expect the curve to behave differently - i.e. for rates to follow the rate decision direction. But the current environment may be considered different by all means. To me this screams concerns around runaway inflation and a heating economy that will eventually draw out a Hawkish FED and put a stop to J Pows favorite actvitiy of heating up the money printer. Inflation expectations drive investors to not lock in current rates and rather pile cash in equity and gold. Another camp argues for higher risk premium demand as the deficits the US is running is loomingly large. Potential signs of stagflation expectations?