- The Menu

- Posts

- Daily Musings

Daily Musings

Billion Dollar Unicorns and My Two Cents

Evening all

the Zeil in Frankfurt does not cease to fascinate. I have seen many strange things on the street that poses as a magnet for tourists and shoppers. Nothing - so I thought - could shock me. But as I trotted down the street, something new caught my eye. No, not the infamous drummer, playing catchy beats on pots and pans while wearing a horse mask. People in camping chairs were cause of surprise today. The line for the iPhone 16 had formed - complete with ice cream and soda vendors catering to the eager waiters that began setting up field camps. While planning for the gelato flavours I will sell when the iPhone 17 gets released, I share today’s musings.

Have a great weekend

Philip

Today’s Stories

Sector expertise matters for lead investors in technical/specialised complex sectors. Pitchbook released a quick AI-driven study showcasing the likelihood of a successful exit (in the form of an IPO or a trade sale) for start-ups is influenced sizeably by the expertise and track record of the lead investor (especially true in later than seed stage investments). VC-backed companies that received funding from a lead investor with high domain expertise were 1.2x more likely to exit successfully than companies that received funding from a lead investor with low domain expertise. The evidence is relatively weak in all-encompassing verticals like SaaS, AI and FinTech which cover almost all VC deals subject to definition, the findings emphasise an uplift, particularly in Healthcare and Pharma.

Chart Art

Qualcomm potentially taking over Intel. The news popped Intel’s share price enough to halt trading. In tandem, they guarantee that an arsenal of junior M&A analysts is shifting their weekend plans. Formerly having been one of them, I sympathise deeply. My back-of-the-envelope thoughts based on what I have glanced at so far:

Qualcomm had been looking at this for some time now

The deal is still in its grassroots

Synergies are largely driven by the combined power in mobile and pc chips - Qualcomm had been a household name in mobile and 5G chips while Intel has continuously outperformed with the x86 processor over Qualcomm’s Arm chips in spaces outside of the phone case

The time is ripe for M&A - Intel’s price has plummitted and the company is struggling with manufacturing and is already planning to cut costs (15% cut to headcount announced in August) - great channel for an acquirer to swoop in an benefit form the already set in transofrmation at a discount

J Powell’s cutto rates opens up headroom to gear up and access cheaper acqusiiton cash

Despite all of this. I peaked quickly at the side by side and the synergies being modelled in have to be sizeable to warrant an accretive (on EPS) acqusiiton (of course just rudimentary back of the napkin analysis):

Intel’s Earnings yield hovers around the 3-3.5% based on Morningstar consensus.

Debt has gotten cheaper but not that cheap. Qualcomm has c. USD 13bn in cash.

Based on the price pop lets ascribe a 15% premium (offer vs. share price) - that would leave an ex-cash gap of UDS 90 to 100bn to come up with.

Qualcomm is almost net cash (EBITDA c. USD 10bn; c. USD 12bn in financial labilities) and hovers around a 7% earnings yield.

Alas this once again shows me what my MD told me in the dimly lit neon light of the banking floor: Make the numbers work.

No large-cap transaction is decided purely on financials. Finanicals will end up supporting the decision a priori. In hindisght we will see who had 20/20 vision.

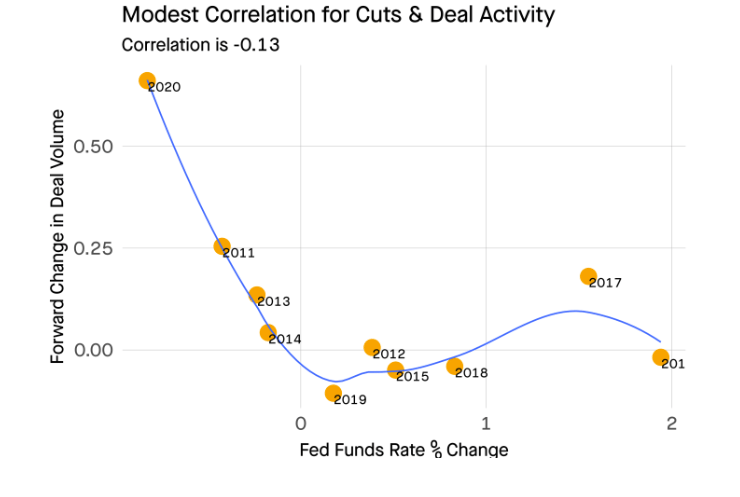

The bread and butter of deal bonanza - rate cuts and easy cash. Correlation analysis for US software VC-backed forward exit activity (with a lag of 1 year) between 2020 and 2010 reveals:

The relationship exists but not substantial

Correlation is not linear for the proposed variables

Particularly worth highlighting the x-axis here: The Fed Funds Rate is measured as a change in percentage on the base of where it started. A 50bps rate cut on a 100bps starting base is set to propel deal activity much stronger than the same quantum in cut on a 550bps starting point - akin to what we have just seen

No strong predictions viable from this chart alone but it provides further sentiment to what seems naturally conclusive: easier cash, more funding and less constrained operating companies that can more easily access lines to achieve their goals should all support stronger and healthier deal activity