- The Menu

- Posts

- Daily Musings

Daily Musings

Billion Dollar Unicorns and My Two Cents

Evening all

I am still recuperating from a sunburn. But German weather is a gift that keeps on giving. Amidst current temperatures I cannot refrain from quoting Game of Thrones:

Winter is coming (a lot quicker than I anticipated)

While I am wondering if Moon Boots are considered business casual I share today’s musings.

Cheers

Philip

Chart Art

Today I share my highlights from a recently published report by Meritech on the state of markets. Shameless self marketing: For a more detailed look at the data as well as additional analysis check out my Medium Article.

Public Performance

S&P 500: Up 24% YTD. 98% L5Y. Fuel: Top tech and AI adjacent firms.

Earnings Reports: Companies in the S&P 500 that mention AI report higher returns compared to those that do not. On average, companies that mentioned AI in Q2’24 earnings returned 12% from EOY‘23 to Q2’24. Companies that did not returned only 9%. Could also be on the back of naturally IT companies mentioning AI more often and the tech sector generally outperforming the overall market currently.

Public SaaS

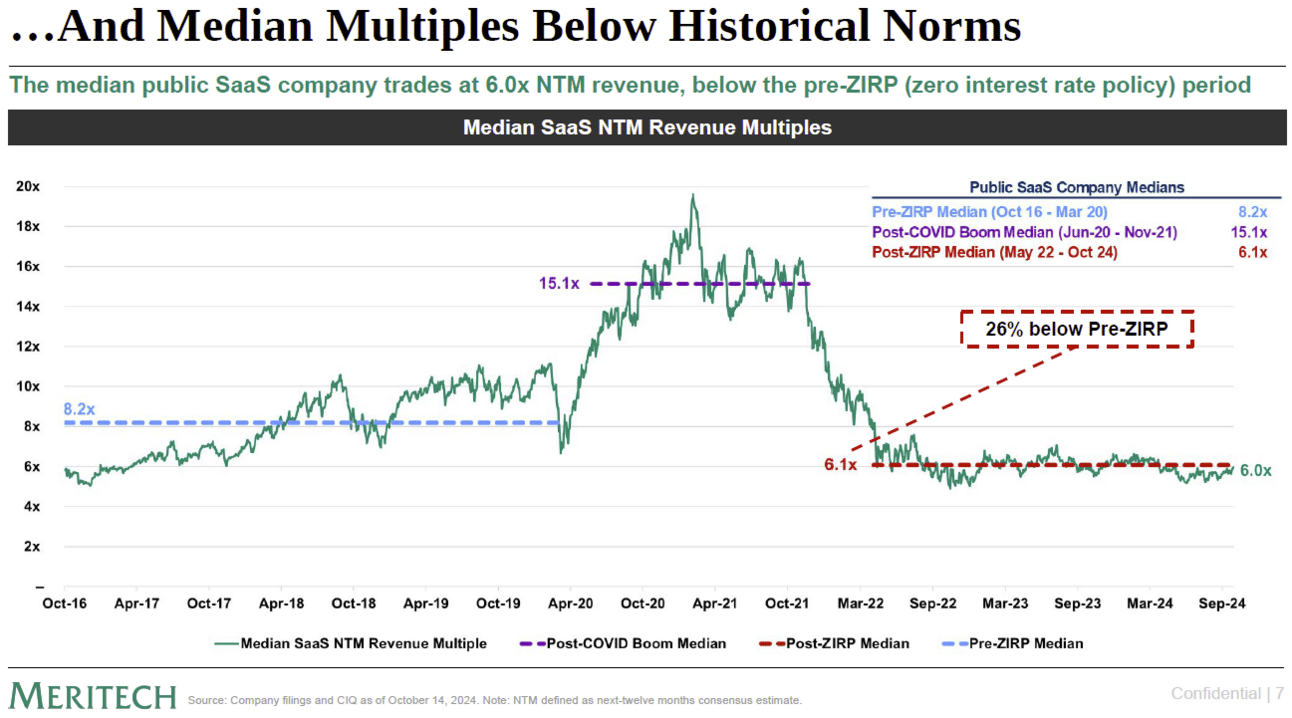

Market Correction: The public SaaS sector experienced its worst correction since 2008 in 2022. Median revenue multiples below historical norms. Currently, the median SaaSCo trades at 6.0x NTM sales, below pre-ZIRP levels.

Growth: The Market has been talking about profitability over growth for some time now. But data remains fixated. Growth is the driver of valuation in SaaS.

Viability Debate: There are ongoing discussions about whether the SaaS model is still viable due to low revenue multiples and poor IPO performance. However, market leaders are poised for growth, especially with AI integration.

IPO Underperformance: SaaS companies that went public in 2020 and 2021 have seen a median loss of 40% since their IPOs. Valuation was frothy during the time. IPOs since 2022 to today are locking in a median +25% performance.

Key Highlight: SaaS market leaders are larger and more valuable than ever before with little to no AI revenue (yet) while the overall index has struggled. AI could make them bigger

Privates

Venture Funding

Stabilization: Venture funding has stabilized since 2021. Unicorn creation remains high - of course particularly in AI (44% of new unicorns in North America YTD are AI / ML). But exits remain dry. Note that the Q3 2024 figure includes the USD 6.6bn OpenAI piece

AI Piece: USD 22.6bn of AI / ML funding compared to USD 44.1bn funding total in Q3 2024.

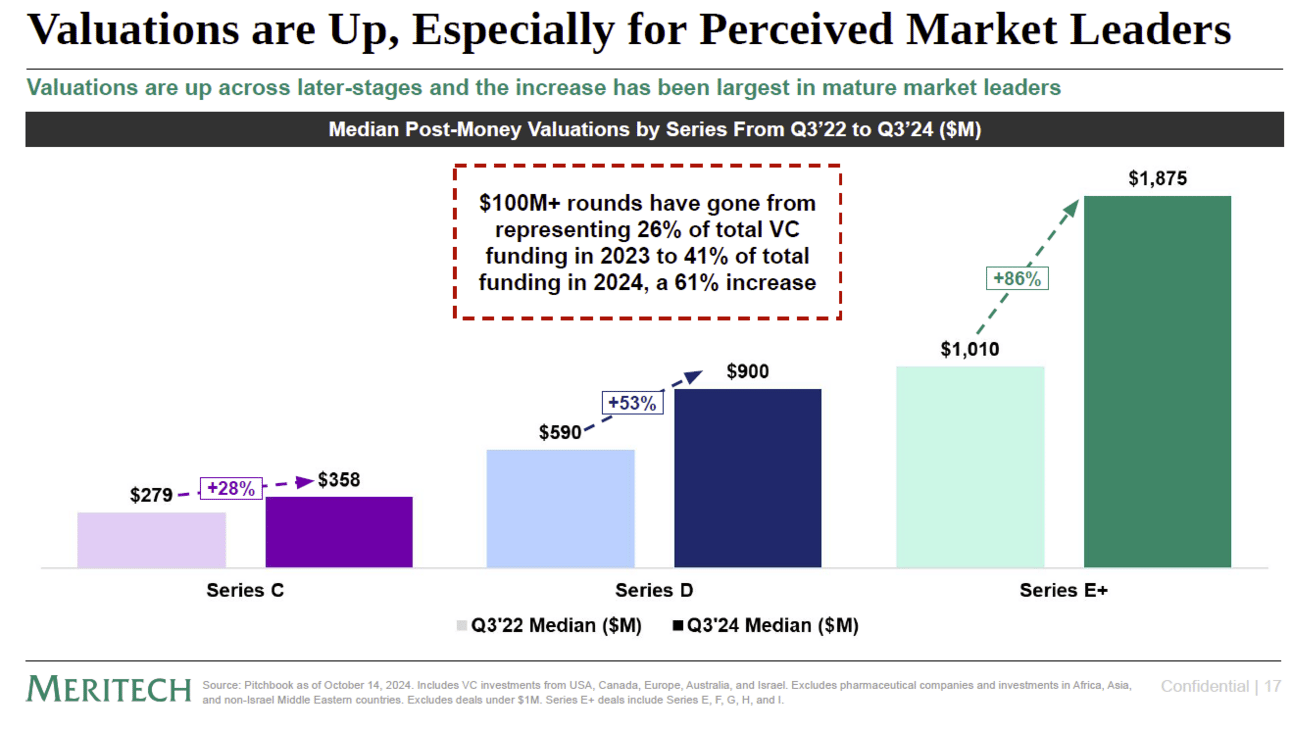

Quality: Companies with proven business models and increasing quality are increasingly valued. Step up in valuation since 2022 significant in later rounds (D and E+). Comparatively stagnant in Series C.

Exit Environment

IPO: Lowest US Tech IPOs in 15 years. 14 US Software IPOs since 2022

M&A regulatory pressure: Stabilizing activity but regulatory challenges loom. Election will be pivotal to steer expectations

Unicorn Factory: Assuming c. 40 Tech IPOs per year it would take just about 25 years to get all of the c. 1,000 North American unicorns to market (c. USD 3.4tn in locked up value). But unicorn creation is slowing down significantly in post-ZIRP. Clearly valuations since 2022 have moderated. So what now? Market leaders exit. The rest is up for consolidation, shut down or a zombie state. Zombiecorns?

AI Opportunity

Market Shift: AI is set to redefine the software landscape and expand the addressable market significantly. Software as a service and service as a software. This cross tapping holds potential to 10x the software opportunity.

AI is Everywhere: Like in ECommerece. Retailers without e-commerce launching today will have a hard time surviving. Software and service companies today without leveraging AI will be the same. To an extent every company is transforming to be an AI company in part.