- The Menu

- Posts

- (Almost) Daily Musings

(Almost) Daily Musings

Billion Dollar Unicorns and My Two Cents

Evening all

Hindenburg. A Paul. A flaming zeppelin. And, more importantly, a short-seller with a kill count that included Nikola and countless Ponzi schemes. Alas, Nathan Anderson and his merry band of 11 are no more.

A sad day. With Enron’s 2024 comeback, Nathan was our best shot at cracking the Nuclear Egg. Still, I’ll sleep easier knowing my portfolio won’t be blindsided by a Hindenburg—both research or a zeppelin crash. With that: today’s musings.

Cheers

Phil

Today’s Takes

Rock, Paper, Scissors. Pebble?

Leave it to a guy named Larry Fink to almost coin his trillion-dollar empire BlackPebble. Nothing like giving trillions in AUM the branding of a skipping stone. Thankfully, BlackRock won the day—I imagine looking at the red numbers across my portfolio being caused BlackPebble ETFs instead of BlackRock. I would be fuming.

BlackRock: Crushing It

The asset management titan just delivered a double-beat earnings report with enough gravity to tilt markets. Let’s break it down:

AUM soared to an all-time high of $11.55T. Up 15% YoY.

Pulled in $641B fresh capital YTD:

$390B funneled into ETFs.

$226B into equity funds.

$164B into fixed income.

The real play? BlackRock’s raid on private credit—the next boogaloo of high finànce. The takeout of HPS adds $148B AUM to the private asset arsenal, with a business model boasting:

60%+ non-sponsor origination. (Translation: no PE middlemen skimming off the top).

Deep roots in the red-hot private credit market, projected to triple from $5.5T (2021) to $15T by 2029 (Preqin data).

So if not sponsor buyouts then what is the credit funding that HPS places? The menu shows: Divi Recaps & Refinancings.

A Leveraged Love Letter to ‘07

Dividend recaps—PE’s nostalgia trip—are back. Why wait for an exit when you can cash out now? Here’s how it works:

Leverage your PortCo to the gills.

Pile on even more debt to make it spicy

Use the proceeds to pay LPs a hefty dividend, often returning 1.5x+ equity investment before the company even exits.

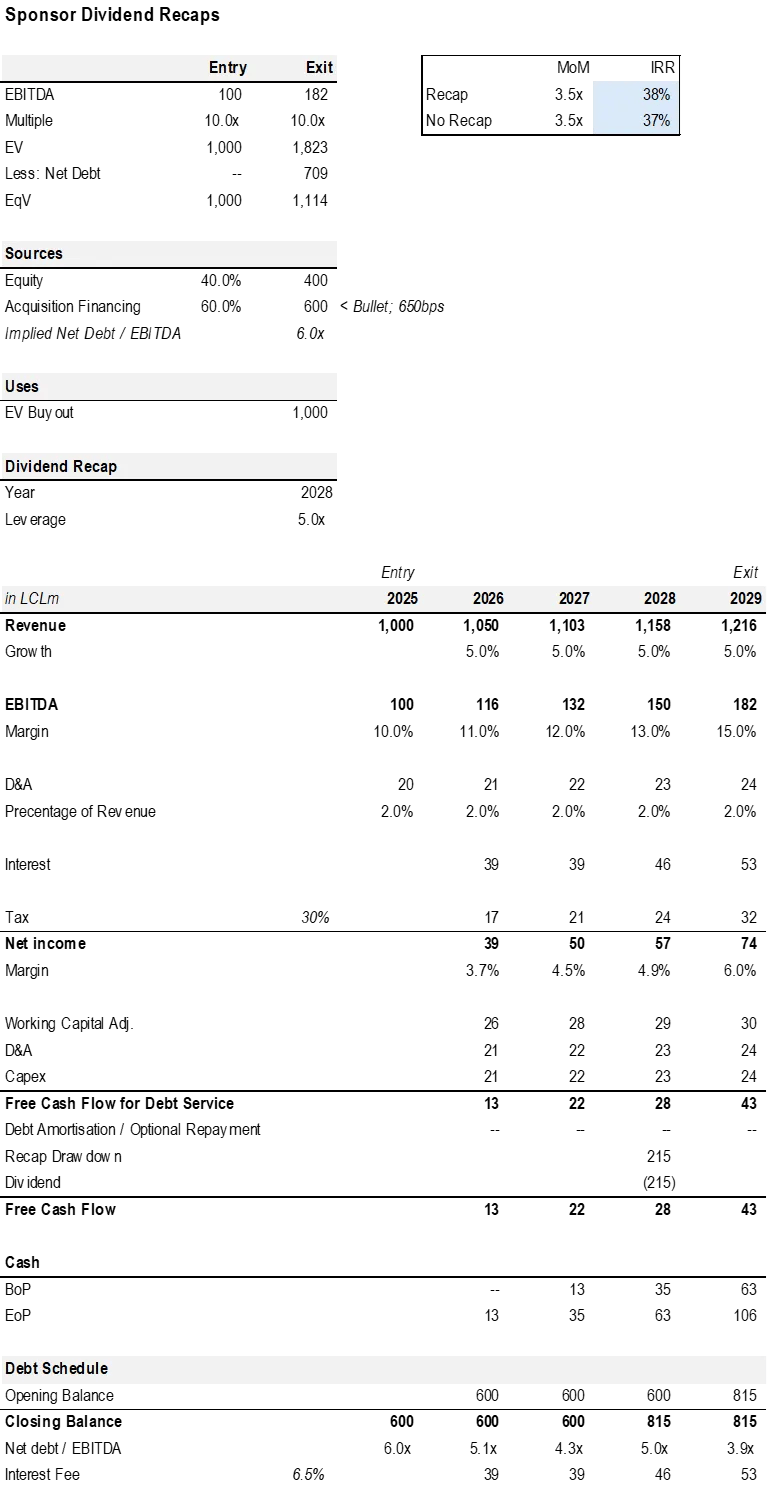

I put together a quick and dirty model explaining the dynamics. No bells. No whistles. Simplified schedules but they do the job: That is illustrating how returns shape out under recaps.

Recap activity in 2024 has already outpaced 2021. Institutional loan volumes hit $30B by April, compared to just $5B for all of 2023.

The Greatest Hits:

Brookfield & CDPQ’s Clarios Deal:

Raised $5B (oversubscribed, upsized by $500M).

Generated a 1.6x dividend on equity—no IPO required.

S&P ratings flagged the deal, noting its reliance on shaky IRA tax credits. $1bn of tax credits on the line that are nothing but Fugazi if DJT scrapes incentive schemes linked to IRA sustainability

BlackRock, CD&R, and GIC’s Belron Play:

Secured €8.1B to fund a €4.4B dividend.

Result: Double the debt, downgrades galore.

Warburg Pincus:

The undisputed recap king: 50% of deals involve recaps.

Returned $50B to LPs on $35B deployed since 2020. (Also just raised a $2B continuation vehicle to brighten their LP smiles further)

Manages to pull this off with some of the lowest-leverage multiples in the game.

Leverage: Stars, Risks, and Warnings

Warburg Pincus, Leonard Green, and Blackstone dominate the recap scene. Risks are clear:

Rising rates = higher default risk.

Clearlake & Platinum: The long-standing LTV MVPs with portfolios averaging 6.6x+ leverage ratios—racking up downgrades faster than upgrades.

Blackstone — newcomer on the block?: Aggressive on recaps but with a dangerous 2x downgrade-to-upgrade ratio. Growing private credit portfolio and appetite for leverage make them one to watch.

Here’s some visual reminders of how leverage plays out across the PE landscape:

(Almost) enjoyed these takes? Share the newsletter via Email, Twitter or LinkedIn with anyone that needs to get more musings into their inbox.