- The Menu

- Posts

- (Almost) Daily Musings

(Almost) Daily Musings

Billion Dollar Unicorns and My Two Cents

Evening all

I write wishlists for Santa. Sam Altman writes them for the U.S. government. Perhaps that’s just founder mode in action—dream big, demand bigger. To each their own, I suppose.

Alas, OpenAI has urged the U.S. government to prioritize AI policy in a 15-page letter, complete with asks for

Freedom from copyright restrictions ("Sharing is caring"—except for the creators?).

Less regulation

Federal funding

While Sam shares wish lists, I share musings.

Cheers

Phil

Today’s Takes

1-800-Seed

Boardy AI just raised $8m, only a few months after closing a $3m pre-seed. Creandum led the round.

My short take: network effects galore. If the AI agents network is truly triple-A quality, maybe it works. If not, one might be better off fostering new connections by buying LinkedIn followers. A simple back-of-the-envelope calculation using suppliers like Omega Marketing gives some insight: for $1,500/month, you can get roughly 1,000 new LinkedIn connections. Considering holiday lulls (hopefully no one’s LinkedIn surfing during Christmas), I’ll deduct two months. That leaves you with 10,000 connections annually for $18k. At $8m, that translates to 533k new connections.

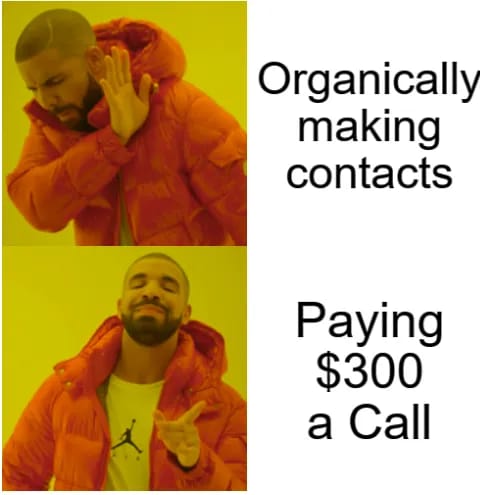

Now, other metrics: the company claims to have made 10k phone calls. In seed investing, industry multiples are sometimes used, so let’s play along. $3m raised last round for 10k calls = $300 per call. I’m not a fan of my SIM provider, but this my Hotline Bling.

(IRR)ational?

Supply and demand are a vicious cycle—one that seems misunderstood by many. Nostalgically, I think back to the days of overshot supply and capex volleys in solar technologies. The logic seems simple: more demand should mean higher prices, right? But here’s the chain of events: suppliers push costs higher, prices rise, demand weakens, and suppliers are forced to compete on margins to attract customers. The weakest players—those with poor efficiencies, weaker customer bases, or immature business models—either fail or consolidate.

It feels like the same trend is playing out in the hyperscaler and GPU space. More demand for AI-capable chips should be driving up prices, yet here we are. An NVIDIA Blackwell chip runs around $30k, with silicon costs of ~$1k. Markups are lovely—for NVIDIA, at least. For those for which they induce traumata from investment banking markups not so much.

Returning from my daydreams of red-pen decks and indecipherable MD notes: GPU supply seems to have been grossly overshot. Older chips are being firesold as they’re outclassed by newer generations, and even the shiny new chips are seeing declining rental prices. FOMO buying is cooling fast.

|  |

Furthermore, the usual AI suspects (A16Z, DeepSeek, etc.) are all echoing the same point: we’re entering the applications era of AI. Training might grab headlines, but inference is where the real compute demand lies—and it’s only a fraction of what training requires. Wrappers, tools, and clever efficiencies are where the action is now.

The $400bn Gap

Sequoia’s analysis points to a $400bn revenue gap for hyperscalers based on implied data center spending. What does that imply?

Option A: Revenue is just early—it will materialize, but later than expected. This shifts ROI timelines and crushes IRR.

Option B: They overestimated the AI hype, overspent, and now face a reckoning. Think firesales, compressed margins, and suboptimal returns.

I modelled out some quick IRR scenarios (very back of the napkin, but good enough for thinking through the range). If revenue comes in between $250-400bn and EBITDA margins range from 35-55%, the difference is 40-45 percentage points in IRR. The gap is brutal—miss revenue and the fall is deep.

But There’s Still a Play

Datacenter spending is high, but the capex bet could still deliver. Why? Because adjacent services matter. Players like Equinix are long on this game, generating consistent revenue and margin momentum from auxiliary services. Hosting, storage, and on-site efficiencies soften the blow of hardware missteps.

It’s clear there’s potential for solid returns. But it hinges on avoiding margin compression—and not everyone can. As the adage goes: Sometimes, being early is just the same as being wrong.

Power Rangers / Dangers

As my AI-driven mood persists, I’ll touch briefly on energy. A recent Tech Tonic podcast by the FT served up this data snack: 35 GW of power is consumed by data centers in the US alone. That’s equivalent to the entire annual power needs of the UK—or roughly 35 average nuclear power plants.

Data centers and the semiconductor industry are voracious consumers of energy. This led me to take a closer look at Taiwan, the global hotspot for semiconductors and home to some 30 colocation data centers. Unsurprising: Taiwan has one of the highest energy import dependencies in the world. Perhaps driven by almost entirely dismantling its nuclear energy capacity? From providing 50% of electricity in 1980, nuclear now accounts for just 5%.

JPMorgan puts it aptly: "One of the most baffling geopolitical decisions I have ever seen."

Taiwan’s heavy reliance on imported fossil fuels for energy puts a glaring spotlight on the fragility of its semiconductor-dominated economy. As the industry continues to expand—and demand for AI chips drives up production—this energy imbalance could become a significant geopolitical and economic risk.

Dry January

Private credit giants are sitting on a mountain of dry powder. S&P data shows Ares with $39bn dry, Blackstone at $25bn, and Oaktree holding $10bn.

Some Context

Capital Efficiency is Lagging:

Ares raised $104bn over the last decade. 37% is dry powder. Too slow to deploy or they’re betting the market softens for better deals.

Blackstone, with $70bn raised, tells a similar story—disciplined or missing?

Banks Are In for the Ride:

Citi-Apollo deal in Sep and Barclays cozying up to Blackstone: Private margins beat bloated balance sheets.

Direct Lending Dominates:

Direct lending hit $800bn AUM in 2024, but note the ratio: dry powder lags at ~30%. Expect tighter deal terms and borrowers losing leverage fast.

Yields vs. Deployment:

Why rush? With risk-free rates at 5.5%, mediocre spreads at 8% don’t cut it. Dry powder is patience, not hesitation. Perhaps.

(Almost) enjoyed these takes? Share the newsletter via Email, Twitter or LinkedIn with anyone that needs to get more musings into their inbox.