- The Menu

- Posts

- (Almost) Daily Musings

(Almost) Daily Musings

Billion Dollar Unicorns and My Two Cents

Evening all

The Deutsche Bundesbank is ahead of the curve. It’s happening now is the motto. Or at least in 2025. The fax: No longer a thing at the digital king.

So while I share today’s musings digitally with you, I am preparing to send it to the Bundesbank via my favourite form of communication next to the mail pigeon: the fax machine.

Cheers

Philip

Today’s Stories

Tech Funding

Intel will receive USD 7.86bn in US government grants to support its chip manufacturing in the country (keep in mind that this figure was at USD 8.5bn in September). The funding is part of the 2022 chips act. Call that just in time delivery as DJT - an avid critic of the act - is preparing for office.

Chart Art

Space VC

Where is Europe leading. Posing a question on: should we fuel innovation to regain category leadership across sciences. Or play into the strengths existing. Arguably the graph states nothing but space science as our forte — something clear to point out, which becomes evident in the point on space science: China is slacking immensely. Is this driven by the research on space by Chinese institutions perhaps being under lock up in a global space race? While I do not have the answer the food for thought experiment may point to a sampling bias in this data set. This comes down to the publishing institutes for respective papers in the respective industries, where these are located etc.

Nonetheless, if we take it for true then I have some EU SpaceTech Data I pulled and some companies that come to mind:

ISAR Aerospace - Series C for EUR 259m in July 2024

D-Orbit - Series C for EUR 150m in September 2024

The Exploration Company - Series B for EUR 150m in November 2024 (about a week ago)

LiveEO - Series B for EUR 25m in June 2024

K2 Space - Series A for EUR 46m in February 2024

EU SpaceTech VC - Facts and Figures

CapEx

Capital light businesses outperform. Comes down to understanding ROIC. Capex without a proportional economic value added component will not accrete to value accordingly. Further consideration: The disconnect has widened massively since ‘08. Could be on the back of the amount of tech driven business since then and therewith simply a function of weighting in the respective indices.

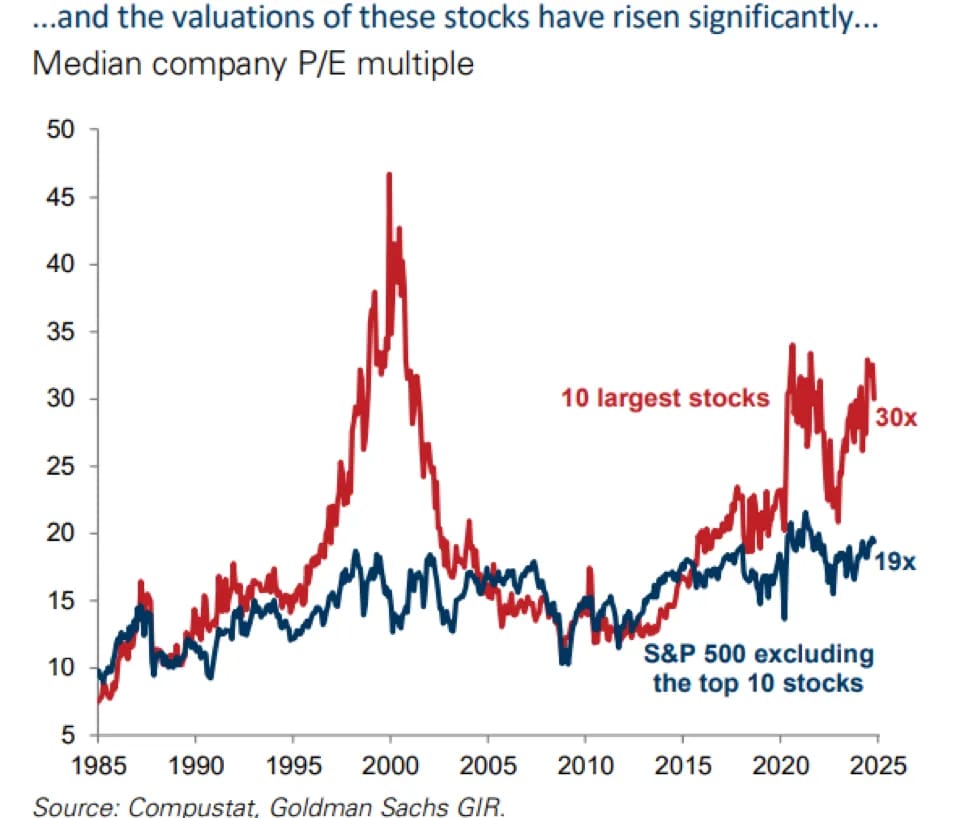

Valuation Froth

Feels like Sparta’s 300 against 10,000. In this case 490 (@19x P/E) against 10 (@30x P/E). Looking at the Nasdaq it may not be without cause. Tech leadership = Growth leadership = higher valuations. Accordingly the tech index has on average demanded a premium in valuation with average P/Es around 21.8x. Though the current 33.4x mark is a stretch above that.