- The Menu

- Posts

- (Almost) Daily Musings

(Almost) Daily Musings

Billion Dollar Unicorns and My Two Cents

Evening all

fresh off the season of gifting, I almost started questioning my spending habits. Getty Images comes in to rescue me from intrusive thoughts with $3.7bn reasons to not worry about my financial decisions. Bold move for an industry one deepfake away from shutting down. Enthralled in M&A momentum, I share today’s musings.

Cheers

Phil

Today’s Takes

Credit Crunch: Is the Party Over?

The balloons are down, the confetti’s swept up, and Party City has officially gone dark after nearly 40 years and 800 stores. PE backer — THL Partners — didn’t stick around for cleanup—they cashed out $350m via the fan favorite aka the dividend recap and left the party. The company once valued at $1.98bn, with $2.2bn in leverage mind you has thus become the poster child of leverage-to-exit.

While Party City closes its doors, the private credit party rages on. Corporate private credit now stands at ~$2tn, with the ABF market commanding a hefty $15tn. Factoring alone sits at $4.18tn, expected to nearly double to $8.4tn by 2030 (CAGR: +10.5%). With Basel III squeezing banks, private credit continues to bridge the gaps—but leverage cuts both ways. Cracks are starting to show.

686 Chapter 11 filings in 2024, the highest since 2010 (828). For context, 2024’s numbers outpaced the combined filings of 2021 and 2022. SMBs are burning out under mounting debt: Undefunded, Overleveraged, Disengaged. What could be the title of a rap album dropping this year is the sentiment broadening at SMBs

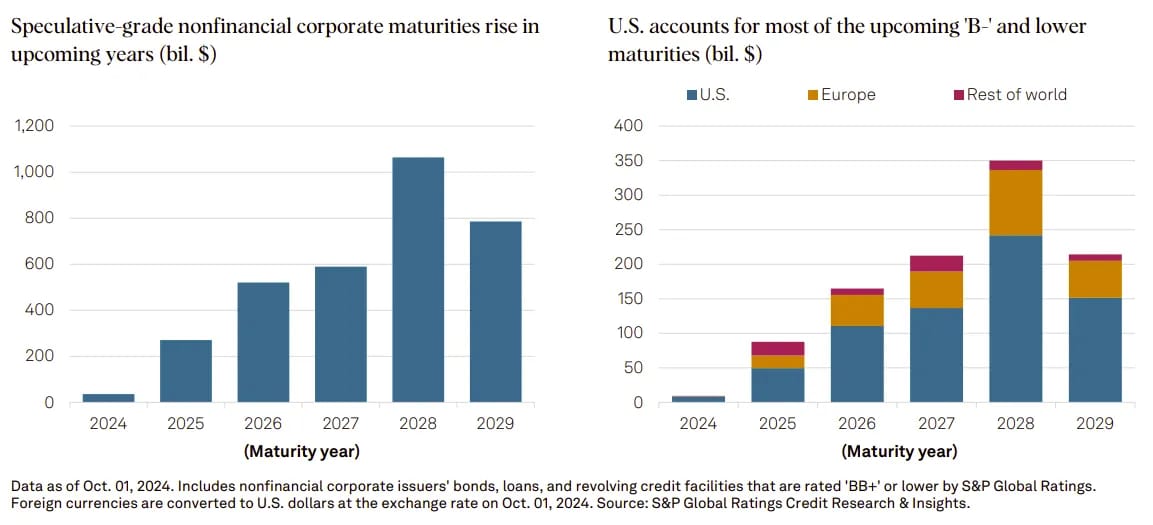

$1.3tn in global corporate debt is rated B- or below, with $875bn in the U.S. alone.

PIK = word of the day. Mentions hitting all-time highs and Cov-lite loans continue dominating. Borrower flexibility > lender protections is the name of the game, with heavyweights like Blue Owl and Clearlake emerging as the MVPs of all the abbreviations that make credit, credit: PIKs, LMEs, Triple CCC, HY.

Then there’s the 2028-2029 maturity wall. With billions coming due, refinancing won’t be so easy, and distressed sales and defaults are all but guaranteed. Sure, LMEs buy time, but history says they’re more stall tactics than solutions:

Of 38 tracked LMEs since 2017, 37% ended in bankruptcy.

Only 14% of "survivors" avoided further defaults or managed to escape CCC+.

Recoveries? A party pooper. First-lien debt is seeing 60-65% recoveries—well below the historical 75-80% average—thanks to giga-gearing, shrinking junior buffers, and the Cov-lite wave. Creditors have become little more than spectators as borrowers restructure at will.

ABF isn’t exactly a safe haven, either. Sourcing receivables is being hyped as the next big thing, but with 500 new strategies launching in 2025, overcrowding feels inevitable. When everyone’s chasing liquidity, the missteps pile up.

The private credit party is still running at full torque, but as Party City proved, the music always stops eventually — if not after the weekend at least by Monday evening.

And don’t look to ABF for salvation. While sourcing receivables is heralded as the next frontier—transforming trade invoices into liquid, self-clearing assets—the sheer volume of activity is staggering. With 500 ABF strategies launching in 2025, the sector is starting to resemble a financial land rush, one likely to end in overcrowding and unrealistic growth expectations.

For now, the private credit ecosystem remains a 24-hour club running Thursday through Monday morning. But just as in the institutions of never ending night life: Eventually the lights turn on. Plan exits accordingly.

AI being AI

Anthropic—four-year-old startup foremost focusing on AI safety—is reportedly closing in on a $2bn round. Led by Lightspeed. Valuation catapulted towards $60bn. This marks a step up of 3x in less than a year and comes just two months after banking a $4bn investment from Amazon. If achieved the Anthropic has earned itself a Top 5 most valuable startup spot, trailling OpenAI, Stripe, SpaceX and Databricks.

Anthropic isn't alone. Some context on the AI arms race:

OpenAI recently secured $6.6bn in equity funding, boosting valuation to an good looking $157bn

The same OpenAI that is not making money with a $200/month subscription and just released their expectation to have working AGI (Skynet: A working title) — better than human performance AI — ready in the next couple of thousand days — love the chose timeline.

Meanwhile, Elon’s xAI raised $6bn at a $45bn valuation

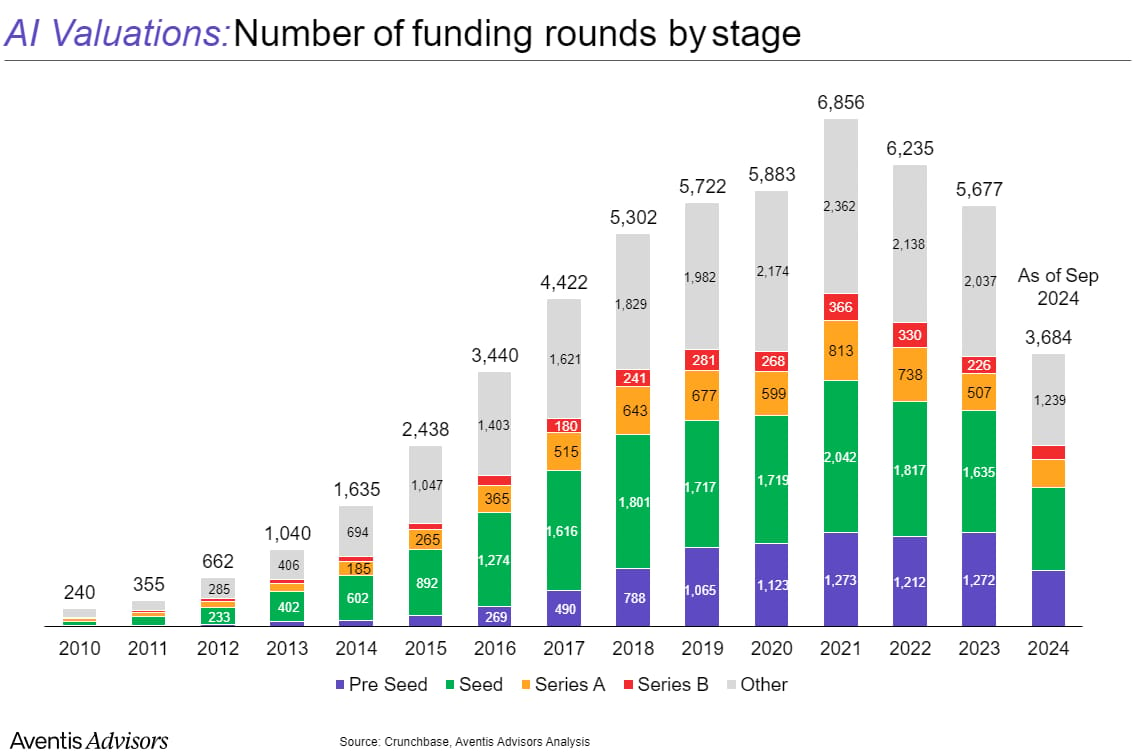

Funding rounds. Not just large but unprecedented. Last year AI players accounted for roughly half of the U.S. VC spend.

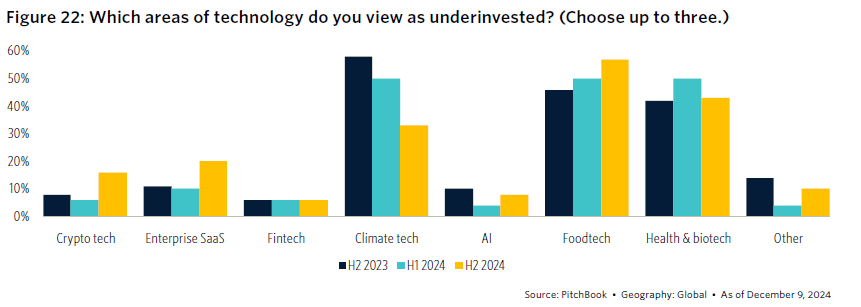

Following VC survey clearly depicts the industry sentiment:

In summary, the AI sector is awash with capital, sky-high valuations, and promises of world-changing technology. Whether this is the dawn of a new technological era or the prelude to an overinflated bubble remains to be seen. For now, investors seem content to throw caution—and billions—to the wind.

(Almost) enjoyed these takes? Share the newsletter via Email, Twitter or LinkedIn with anyone that needs to get more musings into their inbox.